At this point the majority of us are aware of the effects Coronavirus has had on the global economy. Throughout the past week we have seen that fear and anxiety spill into the global markets. With “social-media driven news, the interconnectedness of global supply chains and a pricey stock market, the markets are more vulnerable to these black swans.” (Shah, 2020)—this has inevidtably caused an over-exaggerated sell off.

This is not the first, nor will it be the last time a pathogen hits our population and influences our markets. Here is a history of several epidemics and how the market (specifically the S&P 500) has responded in both 6-month and 12-month periods.

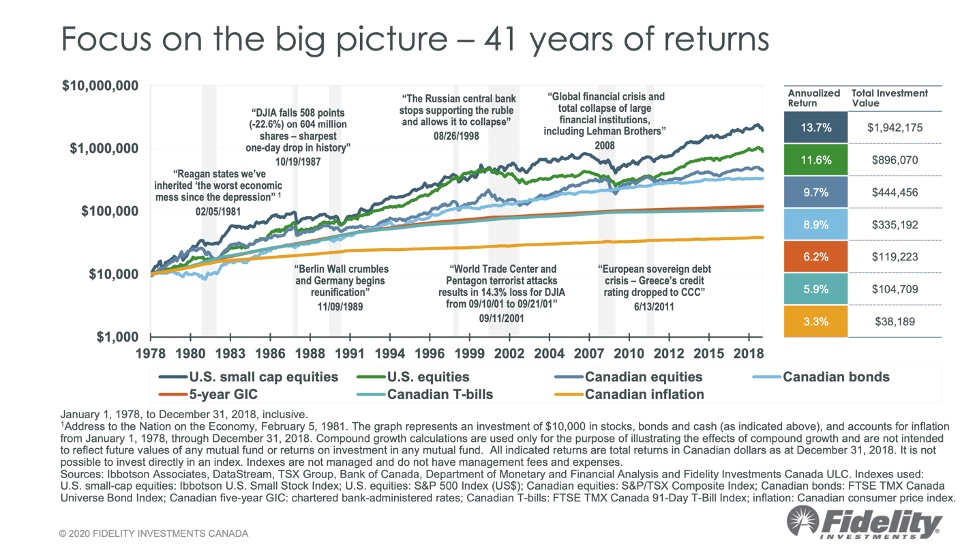

(Fidelity, 2020)

The story history tells is that markets handle epidemics quite well (even in the short-term), and often result in buying opportunities for those who are able to weather the volatility.

Perspectives on Market Selloff

It is my perspective, and the perspective of many Portfolio Managers and Analysts that this selloff is largely an overreaction due to negative investor sentiment. The fundamentals of the Canadian & U.S. economy have not changed, the market is being oversold on virus fears, and the Federal government may step in and cut rates. The epidemic eventually will run its course and world economies, especially the U.S., will resume their decent growth trajectory. So will the U.S. stock market.

Is the coronavirus (COVID-19) a serious health concern? Yes. Is the market selling off because of it? Yes. Does this mean investors should make rash decisions and abandon this bull market because of it? No.

In these periods of heightened volatility, investors are presented with more opportunities to make mistakes – and to panic. It can be tricky to keep a level head and avoid making rash decisions but in times like these it’s wise to let our Portfolio Managers do what they do best… see through the noise and navigate the volatility– Rotating in and out of sectors, positions, and stocks.

Buying Opportunity?

It’s always a question of buying the dip, based on the historical precedent that epidemics and other natural disasters take away growth in the near-term, only to give it back later. Add to this the willingness and ability of governments to throw counter-cyclical stimulus at the problem (fiscal and monetary), and it is a given that this too shall pass. The question is when, and how much, of a drawdown we will need to endure before it does. Whether you are looking for reassurance, or are interested in buying into this weakness, the charts below will be of interest to you:

The above andex chart tells us a story of 41 years of returns. Through recession, crisis, political turmoil, and every other “black swan” thrown at the global economy, the broad markets have continued to grow and persevere in the long-term.

Please contact us directly with any questions that you may have.